nov-zhizn.ru

Gainers & Losers

Chase Bank Or Bank Of America

It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services. First, enroll the Bank of America debit card you use for daily purchases. Pro-tip, use this card for online and recurring payments to collect the most change. 2. Both Bank of America and Chase are popular, offering impressive banking options. Chase holds the top spot in most areas. Learn why in our comparison. Bank of America scored higher in 5 areas: Culture & Values, Work-life balance, Senior Management, CEO Approval and Positive Business Outlook. I like Chase more then BOA, Chase UI for thier website is so much smoother then BOA. And it much cleaner. And less fees for their checking account. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Chase online; credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking and business banking. The bank's score is only slightly better on Trustpilot, where it's currently rated out of 5. However, it's important to note that these reviews are for. JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services. First, enroll the Bank of America debit card you use for daily purchases. Pro-tip, use this card for online and recurring payments to collect the most change. 2. Both Bank of America and Chase are popular, offering impressive banking options. Chase holds the top spot in most areas. Learn why in our comparison. Bank of America scored higher in 5 areas: Culture & Values, Work-life balance, Senior Management, CEO Approval and Positive Business Outlook. I like Chase more then BOA, Chase UI for thier website is so much smoother then BOA. And it much cleaner. And less fees for their checking account. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Chase online; credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking and business banking. The bank's score is only slightly better on Trustpilot, where it's currently rated out of 5. However, it's important to note that these reviews are for. JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial.

Get a comparison of working at Bank of America vs JPMorgan Chase & Co. Compare ratings, reviews, salaries and work-life balance to make the right decision. Link your external accounts to make payments or transfers · Step one Sign in to your Chase Mobile® app and swipe left on your checking account · Step two Tap ". Answer and Explanation: 1. Yes you can, but you must have bank account in bank of America. You can also cash your check with other institutions. For example. Big banks face intensifying political pressure over Zelle fraud: Executives from JPMorgan Chase, Bank of America and Wells Fargo are. The main difference is that Bank of America offers a higher number of free monthly transactions and a higher free cash monthly deposit limit. Both banks offer the same interest rate, but Chase comes out slightly ahead with no initial deposit requirement and a lower monthly service fee. JPMorgan Chase & Co stock has a Value Score of 68, Growth Score of 67 and Momentum Score of Comparing Bank of America Corp and JPMorgan Chase & Co's grades. Get a comparison of working at Bank of America vs JPMorgan Chase & Co. Compare ratings, reviews, salaries and work-life balance to make the right decision. JPMorgan Chase & Co rates % higher than Bank of America on Leadership Culture Ratings vs Bank of America Ratings based on looking at ratings from employees. JPMorganChase to Expand Banking Services for Customers, Communities in Iowa Americans Living Paycheck-to-Paycheck. Learn more. JPMorganChase logo. About. Chase's basic-tier business checking account is better, especially if you need credit card processing. However, Bank of America has lower balance requirements. See our Chase Total Checking offer for new customers. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more. Chase's basic-tier business checking account is better, especially if you need credit card processing. However, Bank of America has lower balance requirements. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Chase continues to offer quite a variety of business checking accounts―from an affordable basic account to premium checking to analyzed checking. The bank's score is only slightly better on Trustpilot, where it's currently rated out of 5. However, it's important to note that these reviews are for. The largest bank, JPMorgan Chase, also has branches in the most states: every state except Alaska and Hawaii. When it comes to choosing a bank, you have many. First Republic now a part of JPMorgan Chase, and its subsidiaries offer private banking, business banking and private wealth management. 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. Citibank – $ trillion · 5. U.S. Bank – $ Bank of America, Chase, Wells Fargo Form New Venture to Help Consumers Make Person- to-Person Payments Electronically. CHARLOTTE, NEW YORK and SAN FRANCISCO.

Is Crypto A Wallet

Crypto wallets hold the user's private key and information, while public keys are located on the blockchain. With the combination of public and private keys, a. With self-custodial wallets, users can retain full custody of their cryptoassets at all times. A crypto wallet is a place where you can securely keep your crypto. There are many different types of crypto wallets, but the most popular ones are hosted. They are open-source cryptocurrency wallets that support over 1, cryptocurrencies in their cold wallet, including Binance coin, Bitcoin, Tether, Ethereum. Cryptocurrency wallets are essential for securely storing cryptoassets and using them in transactions. While crypto exchanges facilitate the buying, selling, and trading of cryptocurrencies, crypto wallets are designed for securely storing and managing users'. A cryptocurrency wallet is a device, physical medium, program or an online service which stores the public and/or private keys for cryptocurrency. Trust Wallet is already “trusted” and used by million people, and is the easiest way to store, send and receive digital assets, manage your NFT collection. A crypto wallet is used to interact with a Blockchain network. The three major types of crypto wallets are hardware, software, and paper wallets. Crypto wallets hold the user's private key and information, while public keys are located on the blockchain. With the combination of public and private keys, a. With self-custodial wallets, users can retain full custody of their cryptoassets at all times. A crypto wallet is a place where you can securely keep your crypto. There are many different types of crypto wallets, but the most popular ones are hosted. They are open-source cryptocurrency wallets that support over 1, cryptocurrencies in their cold wallet, including Binance coin, Bitcoin, Tether, Ethereum. Cryptocurrency wallets are essential for securely storing cryptoassets and using them in transactions. While crypto exchanges facilitate the buying, selling, and trading of cryptocurrencies, crypto wallets are designed for securely storing and managing users'. A cryptocurrency wallet is a device, physical medium, program or an online service which stores the public and/or private keys for cryptocurrency. Trust Wallet is already “trusted” and used by million people, and is the easiest way to store, send and receive digital assets, manage your NFT collection. A crypto wallet is used to interact with a Blockchain network. The three major types of crypto wallets are hardware, software, and paper wallets.

Unlike traditional wallets, crypto wallets don't technically store your crypto—they store your private key. A private key is like a randomized password that. Self-custody your crypto across Bitcoin, Ethereum, Polygon, and other leading blockchains. Get Started. Discover the world of DeFi. Connect to dapps, manage. Crypto wallets are used to buy, sell, send, receive and manage your crypto e.g. ETH, Bitcoin and digital assets e.g. NFTs and to interact with web3 apps. The nov-zhizn.ru DeFi Wallet is designed to give you full control and secured custody of your crypto. Crypto wallets are software programs that store private and public keys used to interact with a blockchain network and manage cryptocurrency. A hot wallet is connected to the internet and could be vulnerable to online attacks — which could lead to stolen funds — but it's faster and makes it easier to. What is a crypto wallet? A crypto wallet is like a digital account where you store and manage your cryptocurrencies, such as Bitcoin, Ethereum, or other. Download nov-zhizn.ru's multi-coin crypto wallet. A simple and secure way to buy, sell, trade, and use cryptocurrencies. Supports Bitcoin (BTC), Bitcoin Cash. A crypto wallet is either a browser extension or a mobile app that allows people to buy, sell, swap, lend and borrow cryptocurrency coins and tokens. Wallets. Cryptocurrency wallets provide access to cryptocurrency and other digital assets. They may be online or offline. Software and web-based wallets are often. Crypto wallets work by storing the private keys for your cryptocurrencies. A wallet holds the credentials needed to prove you own the cryptocurrencies. You can. Over million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on nov-zhizn.ru Join the World's leading crypto trading platform. Digital wallets primarily enable contactless payments through mobile devices or online platforms. They securely store payment card information and facilitate. Without a wallet, you will not be able to store, send, or receive cryptocurrency. They are also important for security purposes. By storing your private keys. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. A cryptocurrency wallet, or crypto wallet, is a software product or physical device that stores the public and private keys to cryptocurrency accounts. The three types of crypto wallets are paper, hardware, and software wallets. Hot wallets are connected to the internet while cold wallets are not. A wallet is a digital tool that allows you to store, send, and receive cryptocurrencies. It interacts with the blockchain to enable transactions and is secured. nov-zhizn.ru is the only app that lets you buy crypto with a card or bank account and self-custody your assets—all in one place. While crypto exchanges facilitate the buying, selling, and trading of cryptocurrencies, crypto wallets are designed for securely storing and managing users'.

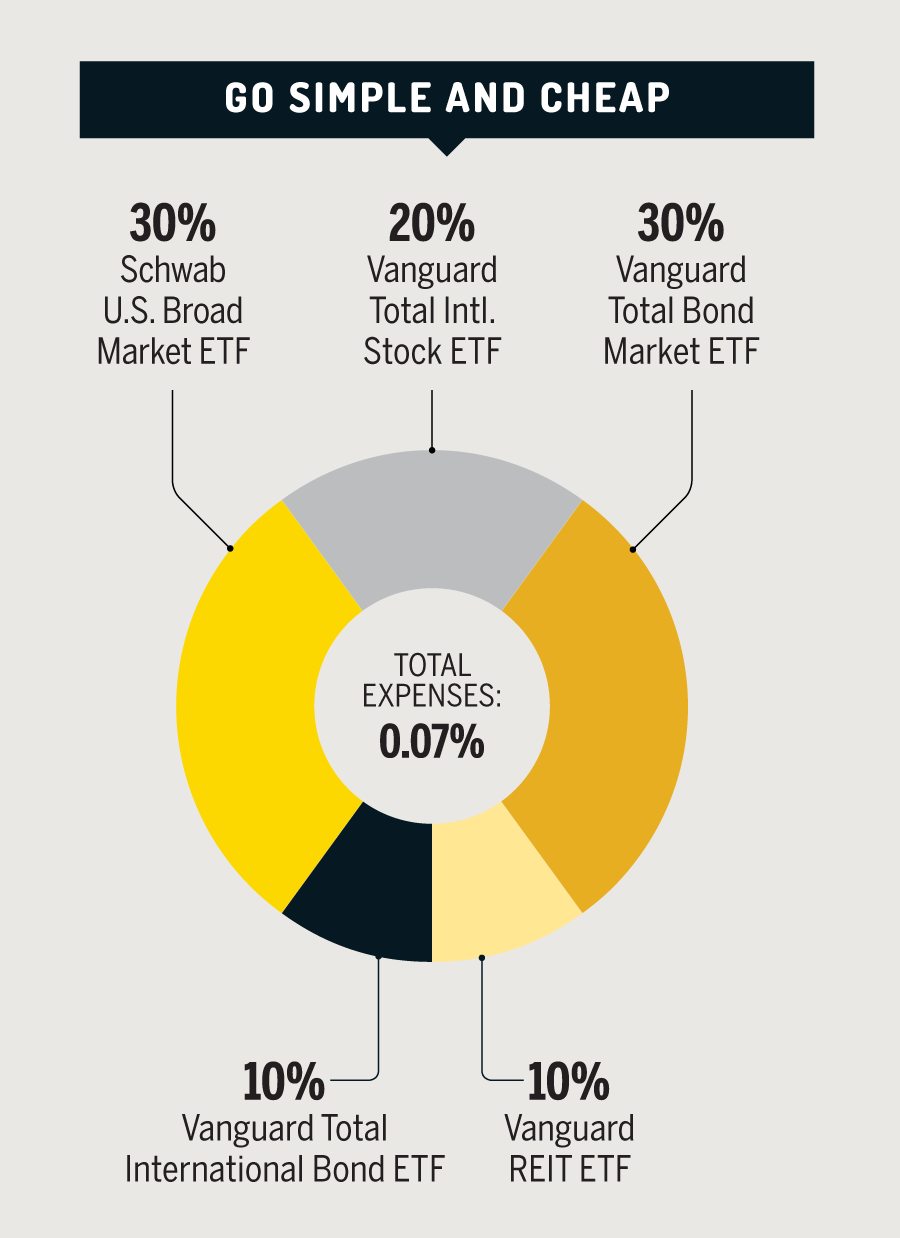

Mainstay Moderate Etf Allocation Fund

The fund may invest approximately 15% (within a range of 5% to 25%) of its assets in Underlying International Equity ETFs. MMRAX Similar Mutual Funds ; TBBPX. American Funds Moderate Growth and Income Portfolio - Class T ; MMRSX. MainStay Moderate Allocation Fund SIMPLE Class ; MMRKX. It seeks to achieve its investment objective by normally investing approximately 60% (within a range of 50% to 70%) of its assets in Underlying Equity ETFs and. MainStay Moderate Allocation Fund As You Sow's Invest Your Values report card grades mutual funds on environmental and social issues, including climate change. The MAINSTAY CONSERVATIVE ETF ALLOCATION FUND CLASS A is an equity fund denominated in USD with a dividend yield of % and quarterly distribution. A high-level overview of MainStay Moderate ETF Allocation Fund A (MDAAX) stock. Stay up to date on the latest stock price, chart, news, analysis. MainStay Moderate ETF Allocation Fund seeks long-term growth of capital and, secondarily, current income by investing approximately 60% (within a range of 50%. MainStay Moderate ETF Allocation Fund Class A, --, +% ; Moderate Allocation, +%, +% ; S&P TR USD, +%, +% ; Fund quartile, --, 3rd. The Fund seeks primarily long-term growth of capital and, secondarily, current income. The Fund seeks to normally invest approximately 60% (within a range of The fund may invest approximately 15% (within a range of 5% to 25%) of its assets in Underlying International Equity ETFs. MMRAX Similar Mutual Funds ; TBBPX. American Funds Moderate Growth and Income Portfolio - Class T ; MMRSX. MainStay Moderate Allocation Fund SIMPLE Class ; MMRKX. It seeks to achieve its investment objective by normally investing approximately 60% (within a range of 50% to 70%) of its assets in Underlying Equity ETFs and. MainStay Moderate Allocation Fund As You Sow's Invest Your Values report card grades mutual funds on environmental and social issues, including climate change. The MAINSTAY CONSERVATIVE ETF ALLOCATION FUND CLASS A is an equity fund denominated in USD with a dividend yield of % and quarterly distribution. A high-level overview of MainStay Moderate ETF Allocation Fund A (MDAAX) stock. Stay up to date on the latest stock price, chart, news, analysis. MainStay Moderate ETF Allocation Fund seeks long-term growth of capital and, secondarily, current income by investing approximately 60% (within a range of 50%. MainStay Moderate ETF Allocation Fund Class A, --, +% ; Moderate Allocation, +%, +% ; S&P TR USD, +%, +% ; Fund quartile, --, 3rd. The Fund seeks primarily long-term growth of capital and, secondarily, current income. The Fund seeks to normally invest approximately 60% (within a range of

Find the latest performance data chart, historical data and news for MainStay Moderate ETF Allocation Fund Class I (MDAIX) at nov-zhizn.ru Fund Details. Legal Name. MainStay Moderate ETF Allocation Fund. Fund Family Name. MainStay Group of Funds. Inception Date. Jun 30, Shares Outstanding. The Underlying Funds are described and offered for direct investment in separate prospectuses. The Fund is designed for investors with a particular risk profile. Holdings Analytics details of MainStay Moderate ETF Allocation Fund | It has 25 holdings and Million in assets | The top 10 holdings represents %. The investment seeks long-term growth of capital and, secondarily, current income. The fund is a "fund of funds" that seeks to achieve its investment. The fund is a "fund of funds" that seeks to achieve its investment objective by investing primarily in mutual funds and ETFs managed by New York Life. Complete MainStay Moderate ETF Allocation Fund;R3 funds overview by Barron's. View the MDARX funds market news. MainStay Moderate ETF Allocation Fund Class A (MDAAX) Holdings Information - View complete MainStay Moderate ETF Allocation Fund Class A holdings for better. MainStay Moderate Allocation Fund MMRDX has $ MILLION invested in fossil fuels, % of the fund. Find the latest performance data chart, historical data and news for MainStay Moderate ETF Allocation Fund Simple Class (MDAVX) at nov-zhizn.ru The Fund seeks long-term growth of capital and, secondarily, current income. The Fund seeks to achieve its investment objective by normally investing. Get MainStay Moderate ETF Allocation Fund Class I (MDAIX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Fund seeks long-term growth of capital and, secondarily, current income. The Fund seeks to achieve its investment objective by normally investing. Complete MainStay Moderate ETF Allocation Fund;R3 funds overview by Barron's. View the MDARX funds market news. A high-level overview of MainStay Moderate ETF Allocation Fund A (MDAAX) stock. Stay up to date on the latest stock price, chart, news, analysis. The investment seeks long-term growth of capital and, secondarily, current income. The fund is a "fund of funds" that seeks to achieve its investment. MainStay Moderate Allocation Fund Prison industrial complex grade: One or more holdings were flagged as private prison operators by our prison industrial. The investment seeks long-term growth of capital and, secondarily, current income. The fund is a fund of funds that seeks to achieve its investment objective. Asset Allocation ; MainStay Defensive ETF Allocation Fund. [__]. [__] ; MainStay Conservative ETF Allocation Fund. [__]. [__].

Top Ten Best Mortgage Lenders

Best mortgage lenders · Best mortgage lender for refinance loans: Guaranteed Rate · Best mortgage lender for VA loans: Rocket Mortgage · Best mortgage lender for. Best Mortgage Brokers in Atlanta, GA · Our Recommended Top 19 · Providers · Liberty Home Mortgages LLC · Mortgage Capital Advisors · Atlantic Home Mortgage · Milend. Scotsman Guide's Top Mortgage Lenders is the only verified ranking of residential lenders and is a benchmark for the mortgage industry. Top 10 Best Mortgage Brokers in Chicago, IL - August - Yelp - Jim Pomposelli - Lakeside Bank, Mike Facchini - Fairway Independent Mortgage Corp. In our analysis, YBS offered the third-highest number of market-leading rates over the month-long period we looked at. It was only beaten by HSBC and Virgin. The Ten Best Reverse Mortgage Companies Today by Total Volume ; FINANCE OF AMERICA REVERSE LLC, 30,, 9,,, ; BANK OF AMERICA, 25,, 6,,, Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination. Best Mortgage Lenders in Michigan · Fairway Independent Mortgage Corporation · Agave Home Loans · Cazle Mortgage · Northstar Bank · LJ Mortgage Team Inc. · Movement. The best mortgage lenders · Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank. Best mortgage lenders · Best mortgage lender for refinance loans: Guaranteed Rate · Best mortgage lender for VA loans: Rocket Mortgage · Best mortgage lender for. Best Mortgage Brokers in Atlanta, GA · Our Recommended Top 19 · Providers · Liberty Home Mortgages LLC · Mortgage Capital Advisors · Atlantic Home Mortgage · Milend. Scotsman Guide's Top Mortgage Lenders is the only verified ranking of residential lenders and is a benchmark for the mortgage industry. Top 10 Best Mortgage Brokers in Chicago, IL - August - Yelp - Jim Pomposelli - Lakeside Bank, Mike Facchini - Fairway Independent Mortgage Corp. In our analysis, YBS offered the third-highest number of market-leading rates over the month-long period we looked at. It was only beaten by HSBC and Virgin. The Ten Best Reverse Mortgage Companies Today by Total Volume ; FINANCE OF AMERICA REVERSE LLC, 30,, 9,,, ; BANK OF AMERICA, 25,, 6,,, Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination. Best Mortgage Lenders in Michigan · Fairway Independent Mortgage Corporation · Agave Home Loans · Cazle Mortgage · Northstar Bank · LJ Mortgage Team Inc. · Movement. The best mortgage lenders · Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank.

Among the best when it comes to online convenience. Offers a full selection of mortgage types and products, including jumbo, home equity, and government loans. Search for mortgage lenders on the largest online directory of licensed lenders. Read thousands of customer reviews to find a lender for your home loan. Next Level Loan Officers. If you are a loan officer looking to take your business to the next level, then this podcast is for you. Bringing. For one, you can expect to pay PMI. In most cases, lenders require private mortgage insurance on any loan that contributes more than 80% of the home purchase. Best Mortgage Lenders of August ; New American Funding. NMLS # ; Rocket Mortgage. NMLS # ; NBKC Bank. NMLS # ; Farmers Bank of. Top mortgage stocks in ranked by overall Zen Score. See the best mortgage stocks ROCKET COMPANIES INC. NYSE. Mortgage Finance. Unlock, $B, $ Mortgage lender reviews by category ; Mortgage. Quicken Loans; Rocket Mortgage ; Refinance. Rocket Mortgage · Veterans United ; HELOC. Bank of America · Wells. Best Mortgage Lenders ; AmeriSave Mortgage. Overall Score · 2, User Reviews. Get Rates and Pre-Qualified in 3 Minutes; Close in 25 Days or Less ; Better. Why it works: This online mortgage lender website has a very sleek and modern design. They use professional colors, icons, and fonts. Another great thing about. Hollywood is home to the Walk of Fame and many famous movie theaters. Beverly Hills is known for its luxurious hotels and shopping districts. Downtown LA is. Looking for the best mortgage lender? Our top picks include New American Funding, Cardinal Financial, AmeriSave and Rocket. Compare rates and reviews. Visit Movement Mortgage site. NMLS # Bankrate Score. Rating: 4 stars out of 5. Consumer reviews. Rating: stars out of 5. 10 reviews ; Visit. You can potentially qualify for an FHA loan with a credit score as low as if you're able to put 10% down. USDA loans. To incentivize purchases in certain. Bank of America was the highest-rated “big bank” lender based on our scoring methodology. It has top-notch educational resources, multiple ways to reach. Serving the following areas: · PAC Charter Mortgage Services Inc. · VanKeef Financial, LLC · VanKeef Financial, LLC · Mutual of Omaha Mortgage · Supreme Lending. C2 Financial Corporation was ranked as the top mortgage broker in America by AIME in , , and They closed on 8, loans with a total volume of. The 10 Best Mortgage Lenders of Rates and Reviews. Learn about the best mortgage lenders on the market. Compare top lenders for mortgage rates. Mortgage Executive Magazine compiles a list of the nation's top closely held mortgage companies and publicly traded banks, ranked by total yearly mortgage. Top 10 Best Mortgage Brokers in Phoenix, AZ - August - Yelp - Jeremy Schachter & Zac White - Fairway Independent Mortgage, Lizy Hoeffer - CrossCountry. They often can and will get the best deals with companies you've Recommended Mortgage Lenders in the area? 14 upvotes · 60 comments.

Most Affordable Cities For Seniors

10 Affordable Cities for Retirement ; Winchester, Virginia · Winchester Insider · $, ; Portland, Maine · Portland Insider · $, ; Gainesville, Georgia. For those who can't wait for a change in policy or for demand to fall, the report also identifies the most affordable cities of the 94 surveyed. According to the Missouri Economic Research and Information Center, the lowest overall costs of living were found in Mississippi, Oklahoma, Kansas, Alabama, and. Here are the most affordable, LGBTQ+-friendly cities for gay people to retire. For more on building wealth, check out this video and get a. Greensboro is a great choice for seniors. The small-town feel, low cost of living, and close proximity to major locations like Charlotte and the Raleigh and. Most cities in Tennessee have below-average living costs for retirees, and house prices are 30% below the US average. It has one of the friendliest tax climates. 1. Montgomery, Alabama Alabama's capital city of Montgomery took the top spot on WalletHub's list of affordable places to retire, the highest ranking of the. 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott, Arizona · 3. Hot Springs, Arkansas · 4. Grand Junction, Colorado · 5. Here Are the 11 Best Places to Retire on a Budget · 1. St. George, Utah · 2. Palm Coast, Florida · 3. Loveland, Colorado · 4. Cape Coral, Florida · 5. Surprise. 10 Affordable Cities for Retirement ; Winchester, Virginia · Winchester Insider · $, ; Portland, Maine · Portland Insider · $, ; Gainesville, Georgia. For those who can't wait for a change in policy or for demand to fall, the report also identifies the most affordable cities of the 94 surveyed. According to the Missouri Economic Research and Information Center, the lowest overall costs of living were found in Mississippi, Oklahoma, Kansas, Alabama, and. Here are the most affordable, LGBTQ+-friendly cities for gay people to retire. For more on building wealth, check out this video and get a. Greensboro is a great choice for seniors. The small-town feel, low cost of living, and close proximity to major locations like Charlotte and the Raleigh and. Most cities in Tennessee have below-average living costs for retirees, and house prices are 30% below the US average. It has one of the friendliest tax climates. 1. Montgomery, Alabama Alabama's capital city of Montgomery took the top spot on WalletHub's list of affordable places to retire, the highest ranking of the. 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott, Arizona · 3. Hot Springs, Arkansas · 4. Grand Junction, Colorado · 5. Here Are the 11 Best Places to Retire on a Budget · 1. St. George, Utah · 2. Palm Coast, Florida · 3. Loveland, Colorado · 4. Cape Coral, Florida · 5. Surprise.

We've mashed up the latest data of the top 20 cities with the most annual sunshine possible from the National Oceanic and Atmospheric Administration (NOAA). 10 Affordable Cities for Retirement ; Winchester, Virginia · Winchester Insider · $, ; Portland, Maine · Portland Insider · $, ; Gainesville, Georgia. 17 votes, 38 comments. 74K subscribers in the retirement community. Table talk for those already are, or soon to be, a Traditional age 59+. 5 Affordable Beach Retirement Towns · 1. Gulfport, Mississippi · 2. Pensacola, Florida · 3. Corpus Christi, Texas · 4. Astoria, Oregon · 5. Bluffton, South Carolina. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the. Cities like Bakersfield, Fresno, and Modesto provide access to healthcare facilities as well as options for affordable housing. For retirees seeking a laid-back. Live Life to the Fullest With These Affordable Retirement Communities in North Carolina · What is a Certified Community? · Lumberton — A Central Destination For. Most cities in Tennessee have below-average living costs for retirees, and house prices are 30% below the US average. It has one of the friendliest tax climates. Live Life to the Fullest With These Affordable Retirement Communities in North Carolina · What is a Certified Community? · Lumberton — A Central Destination For. If finding an affordable town to live in is your number one priority, don't overlook Huntsville, Alabama. It came in as the most affordable retirement spot. The 10 Sunniest, and Most Affordable, Cities for Retirees · Ely, Nevada · Pueblo, Colo. · Amarillo, Texas · Lubbock, Texas · Roswell, N.M. · Lake Charles, La. Eureka Has Some of the Most Affordable Homes in California If your ideal retirement locale is one without crowds, traffic, and pollution, consider small town. The most affordable cities for working adults are Sioux Falls, SD; Springfield, IL; and Wichita, KS. Top desired cities to live in are Denver, CO; San Diego. Eureka Has Some of the Most Affordable Homes in California If your ideal retirement locale is one without crowds, traffic, and pollution, consider small town. Florida has the best tax breaks for retirees, & a subtropical climate. There are still cities there that aren't overpriced & are safe do a. Here are the most affordable, LGBTQ+-friendly cities for gay people to retire. For more on building wealth, check out this video and get. Here are the most affordable, LGBTQ+-friendly cities for gay people to retire. For more on building wealth, check out this video and get a. The ranking lists cities in the world in order, from the most expensive to the least expensive places to live. The comprehensive ranking serves as a. 1. Montgomery, Alabama Alabama's capital city of Montgomery took the top spot on WalletHub's list of affordable places to retire, the highest ranking of the. Orlando, FL, is the best place to retire, living up to its reputation as a haven for seniors. One big reason for this is the lack of taxes, as Orlando is one of.

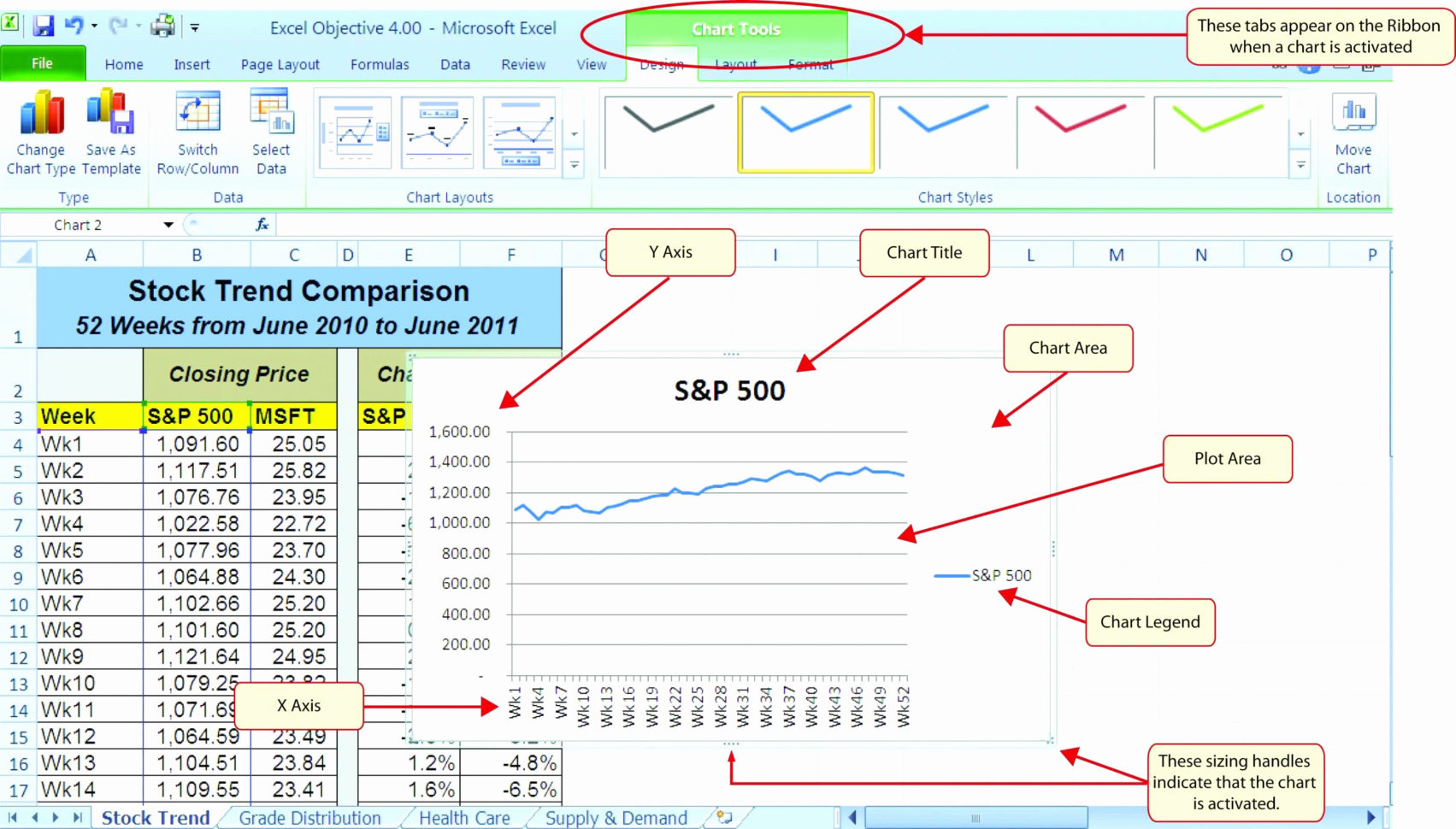

Wps Data Analysis

Data, analysis and new tools for understanding the value of addressing WPS barrier analysis focus groups for command members from Feb. 28 to Mar. 3. Spatial analysis tools for Geotools, Geoserver WPS, uDig Statistics Toolbox - mangosystem Designed for interoperability, it publishes data from any major. First, you have to add the Analysis Tool Pack: Go to File >> (More >>) Options >> Add-ins >> now, select and add the analysis Toolpack. . data (Pressure level and surface analysis) as you know, there are a lot of parameters in both of them. due to the limitation in processing, it is important. EYE PROTECTION MODE | NIGHT MODE | WPS OFFICE · REGRESSION ANALYSIS USING TRENDLINE | WPS SPREADSHEET · PIVOT TABLES DATA ANALYSIS | WPS. A powerful & scalable analytics platform you can trust. Supports multiple languages (SAS, R, Python & SQL). Single unified platform for all your analytics use. Assistance with research data analysis/support for publication in scientific journals; Direct payment to participating individuals or agencies. Free WPS test. Manager, Data & Analytics at WPS Health Solutions · My passion is making meaning and finding possibly small, but important trends in both quantitative and. All WPS data and analysis findings are available at nov-zhizn.ru Program Overview. PDC's Women, Peace and Security (WPS) analytical framework. Data, analysis and new tools for understanding the value of addressing WPS barrier analysis focus groups for command members from Feb. 28 to Mar. 3. Spatial analysis tools for Geotools, Geoserver WPS, uDig Statistics Toolbox - mangosystem Designed for interoperability, it publishes data from any major. First, you have to add the Analysis Tool Pack: Go to File >> (More >>) Options >> Add-ins >> now, select and add the analysis Toolpack. . data (Pressure level and surface analysis) as you know, there are a lot of parameters in both of them. due to the limitation in processing, it is important. EYE PROTECTION MODE | NIGHT MODE | WPS OFFICE · REGRESSION ANALYSIS USING TRENDLINE | WPS SPREADSHEET · PIVOT TABLES DATA ANALYSIS | WPS. A powerful & scalable analytics platform you can trust. Supports multiple languages (SAS, R, Python & SQL). Single unified platform for all your analytics use. Assistance with research data analysis/support for publication in scientific journals; Direct payment to participating individuals or agencies. Free WPS test. Manager, Data & Analytics at WPS Health Solutions · My passion is making meaning and finding possibly small, but important trends in both quantitative and. All WPS data and analysis findings are available at nov-zhizn.ru Program Overview. PDC's Women, Peace and Security (WPS) analytical framework.

Provides a Web Processing Service for climate data analysis using ESMValTool. The software in this WPS powers the processes behind the C3S-MAGIC portal. What We Do · Claims Administration · Billing and Enrollment · Data Analytics · Federal Interconnect and Data Transfer Services · Secure Print and Mail Services—. Choose cloud, on-premises, or hybrid infrastructure and simplify end-to-end analytics workflows from multiple siloed data processes. Streamline DevOps. I favor employing robust database management systems or data analysis tools like SQL, Python, or R for managing very big data sets or sophisticated calculations. You provide the data and parameters for each analysis, and the tool uses the appropriate statistical or engineering macro functions to calculate and display the. Download scientific diagram | The work packages (WPs) structuring the data collection and analysis from publication: CLIMATE CHANGE AS TRIGGER FOR. The growth and productivity statistics (WPS) is a set of indicators for statistical analysis in the fields of macroeconomics. r/dataanalysis. Join. Data Analysis: share tips & resources, ask questions, get help. This is a place to discuss and post about data analysis. - WPS is changing the healthcare and pharmaceutical landscape by implementing data analytics to truly understand and deliver the best experience to their. WPS Analytics is a unique platform that works for data engineers, analysts, data scientists, modelers, and DevOps. We have relied on this product for years. The function of “Filters” helps users present and analyze PivotTable data more focused according to the needs of analysis or reports. In this. Job Description: Description. Data Analyst. Role Summary: This role serves the Government Health Administrators (Medicare) division through statistical data. analysis toolpak in wps spreadsheet download. out of 5. 10 votes. When we organize the data of the document, we usually insert a chart for a supplementary. The WPS service is available as an extension for GeoServer providing an execute operation for data processing and geospatial analysis. WPS is not a part of. WPS is used in production on a huge range of systems at sites around the world. Thousands of analysts are using WPS in their daily data processing and analysis. Accurate and Reliable Plant Data Analysis with WPS Phenotyping Platforms. Our Phenotyping Platforms: the ultimate solution for acquiring accurate and. Optimize your parking policy and operational management with Monit. Monit brings extensive parking expertise and advanced data analysis technology together. WPS capabilities, the data can be accessed by any client that supports WPS. Before configuring a WPS service, you must publish your analysis to ArcGIS Server. I am using WPS Spreadsheet since 1 year for Salesforce Data Migration. I used it for data analysis purposes. Review collected by and hosted on G2. nov-zhizn.ru: Four-in-one WPS office application: document processing + data analysis + presentation presentation + mobile office (produced by Asynchronous.

Fastest Way To Raise My Credit Score

How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Even if you don't have a credit card, you can ask that utility bills or other regular bill payments be added to your credit report. For fixed-rate loans, such. You can raise your credit score quickly by following a few simple steps. Learn about what factors can raise your credit score, what to expect and more. Quick Loan Shopping. If you have bad credit and can't find any other way to improve your score, you could consider taking a “quick. 1. **Pay Down Balances**: Reducing credit card balances can quickly improve your credit utilization ratio. · 2. **Correct Errors**: Dispute and. Simple ways to raise your credit score · Check for errors on your credit report · Experian Dark Web Scan + Credit Monitoring · Refinance your credit card debt. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Even if you don't have a credit card, you can ask that utility bills or other regular bill payments be added to your credit report. For fixed-rate loans, such. You can raise your credit score quickly by following a few simple steps. Learn about what factors can raise your credit score, what to expect and more. Quick Loan Shopping. If you have bad credit and can't find any other way to improve your score, you could consider taking a “quick. 1. **Pay Down Balances**: Reducing credit card balances can quickly improve your credit utilization ratio. · 2. **Correct Errors**: Dispute and. Simple ways to raise your credit score · Check for errors on your credit report · Experian Dark Web Scan + Credit Monitoring · Refinance your credit card debt. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt.

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. Some of the best ways to improve your credit score quickly when you have no credit history include becoming an authorized user, opening secured credit cards, or. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available. After looking at 50, Credit Strong credit builder accounts, we found that, on average, account holders improved their FICO score by more than 25 points. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent. Seven Steps to Improve Your Credit Score. The fastest way to improve your credit score is to stop using your credit cards and pay down the balance on each and. But it generally takes about three to six months to get your first credit score. The timing depends on factors like what your credit scores are now and how you'. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The typical guidance. FICO says paying down your overall debt is one of the most effective ways to boost your score. Don't close paid-off accounts. Closing unused credit card. 8 ways to help improve your credit score · 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. · 4. 1. **Pay Down Balances**: Reducing credit card balances can quickly improve your credit utilization ratio. · 2. **Correct Errors**: Dispute and. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. Asking for a higher credit limit can improve your credit score quickly. If your credit card has a limit of $, ask for an increase to $ or $ This.

How Far Back Do Rental Background Checks Go

So, how far back do background checks go in Florida at Level 2? Florida has no laws limiting how far back an employer can seek criminal convictions in a. The majority of background checks for apartments take between a few days and a few weeks. This is an essential step in any apartment rental. How far back do most apartment background checks go? ; seven years, some to 10 years. This duration aligns with the limitations set by the ; Fair Credit Reporting. Most landlords will do a criminal background check, so it's better to be upfront and let them know what they can expect. For example, if you have any prior. In California, you also have the right to request a copy of your report for at least 2 years after the background check company provides your report to the. No. You are only required to run a criminal background check each time you have a new tenant 18 years or older. How far back does the background check go? An apartment background check typically looks back at the last seven years of your life, but some landlords may go. While landlords might still run background checks, the Act limits when and how they can use the results. Certain parts of your criminal record, like arrests. How Far Back Does a Background Check Go? According to TransUnion, the credit report will go back around seven to ten years. As mentioned above, your criminal. So, how far back do background checks go in Florida at Level 2? Florida has no laws limiting how far back an employer can seek criminal convictions in a. The majority of background checks for apartments take between a few days and a few weeks. This is an essential step in any apartment rental. How far back do most apartment background checks go? ; seven years, some to 10 years. This duration aligns with the limitations set by the ; Fair Credit Reporting. Most landlords will do a criminal background check, so it's better to be upfront and let them know what they can expect. For example, if you have any prior. In California, you also have the right to request a copy of your report for at least 2 years after the background check company provides your report to the. No. You are only required to run a criminal background check each time you have a new tenant 18 years or older. How far back does the background check go? An apartment background check typically looks back at the last seven years of your life, but some landlords may go. While landlords might still run background checks, the Act limits when and how they can use the results. Certain parts of your criminal record, like arrests. How Far Back Does a Background Check Go? According to TransUnion, the credit report will go back around seven to ten years. As mentioned above, your criminal.

Online Tenant Screening Services for landlords, property managers, and businesses. Tenant Background and Credit Checks starting at $! There is no requirement as to how far back one must search. Background checks requested through C4 Operations are FCRA compliant and provide only information. If a renter is serious about signing a lease for an apartment, a landlord should get serious about checking their references. Landlords should ask for at least. The idea is to give employers or landlords a sense of your legal history without going too far back into your past. Employment History. Your. My fiancé and I are looking to move to St. Louis MO and will be renting a place while we get settled before buying a house. Here at the TRC, we want to make sure the landlords who come Then a landlord should look for evidence about rent payment history (can they afford rent now? The Eviction History will let you discover whether the applicant has a history of evictions from previous rental properties. You will learn about recent. The Eviction History will let you discover whether the applicant has a history of evictions from previous rental properties. You will learn about recent. Housing providers may require individuals to undergo a criminal background check as part of the application process. A provider may use results of the criminal. Behind the smile and seemingly pleasant personality may lurk the tenant in every landlord's nightmares. The cost of the Virginia Tenant Screening is easily. How far back does my tenant screening report go? Tenant screening agencies can only report unpaid bills and evictions for 7 years. Bankruptcies are reported. No arrest records, charges, violations, or sealed / expunged cases can be considered for the adverse action. This three year look-back does not apply to current. Housing providers cannot make any statement indicating a blanket ban on renting to anyone with a criminal record. The law prohibits advertisements, screening. Most landlords will do a criminal background check, so it's better to be upfront and let them know what they can expect. For example, if you have any prior. There is no requirement as to how far back one must search. Background checks requested through C4 Operations are FCRA compliant and provide only information. the look-back period should be calculated from the date of the last conviction. application, the landlord shall make available to the applicant printed notice. So, how far back do background checks go in Florida at Level 2? Florida has no laws limiting how far back an employer can seek criminal convictions in a. Also, if you're wondering, “does TurboTenant check credit?” TurboTenant's partners may pull credit reports typically covering seven years, criminal records can. Do you have an eviction on your record? Unfortunately, even if you never went to court, if a landlord ever filed a lawsuit to evict you, it will show up on your. While landlords might still run background checks, the Act limits when and how they can use the results. Certain parts of your criminal record, like arrests.

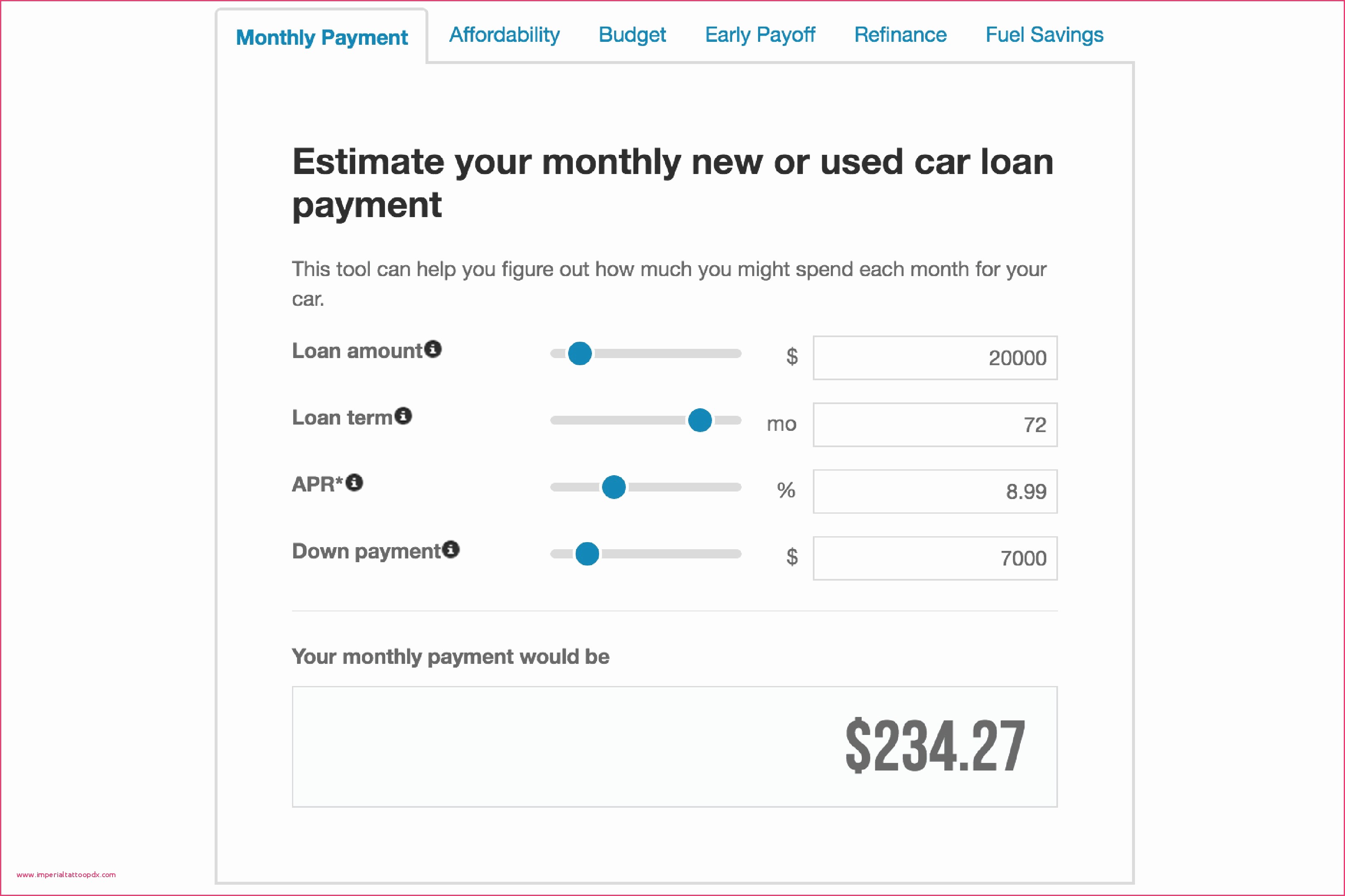

Calculating Adjustable Rate Mortgage

Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you estimate your mortgage payments. UniBank's Adjustable Rate Mortgage (ARM) Calculator helps you easily determine what your adjustable mortgage payments may be. Learn more now! Calculate your adjustable-rate mortgage payments with ease. Get accurate results to manage your finances better. Try our calculator now! This adjustable-rate mortgage calculator helps you to approximate your possible adjustable mortgage payments. Starting adjustable monthly payment is $ Thinking of getting a variable rate loan? Use this calculator to figure your expected monthly payments — before and after the reset period. This calculator will help you to determine what your estimated adjustable rate mortgage payments will be for a range of interest rates. UniBank's Adjustable Rate Mortgage (ARM) Calculator helps you easily determine what your adjustable mortgage payments may be. Learn more now! This calculator computes the estimated payments and interest for an adjustable rate loan, where the rate increases by the maximum amount allowed at each. Thinking of getting a variable rate loan? Use this calculator to figure your expected monthly payments — before and after the reset period. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you estimate your mortgage payments. UniBank's Adjustable Rate Mortgage (ARM) Calculator helps you easily determine what your adjustable mortgage payments may be. Learn more now! Calculate your adjustable-rate mortgage payments with ease. Get accurate results to manage your finances better. Try our calculator now! This adjustable-rate mortgage calculator helps you to approximate your possible adjustable mortgage payments. Starting adjustable monthly payment is $ Thinking of getting a variable rate loan? Use this calculator to figure your expected monthly payments — before and after the reset period. This calculator will help you to determine what your estimated adjustable rate mortgage payments will be for a range of interest rates. UniBank's Adjustable Rate Mortgage (ARM) Calculator helps you easily determine what your adjustable mortgage payments may be. Learn more now! This calculator computes the estimated payments and interest for an adjustable rate loan, where the rate increases by the maximum amount allowed at each. Thinking of getting a variable rate loan? Use this calculator to figure your expected monthly payments — before and after the reset period.

Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Adjustable rate mortgage (ARM). This calculator shows a "fully amortizing" ARM, which is the most common type of ARM. The monthly payment is calculated to pay. Calculate your adjustable-rate mortgage payments with ease. Get accurate results to manage your finances better. Try our calculator now! Use this calculator to estimate your monthly home loan payment with different interest rates on an adjustable-rate mortgage. Use this calculator to estimate your monthly home loan payment with different interest rates on an adjustable-rate mortgage. This calculator will show you your monthly payment for an ARM based on your loan amount, loan terms and interest rate. In the early years of your mortgage. Adjustable rate mortgage (ARM). This calculator shows a "fully amortizing" ARM, which is the most common type of ARM. The monthly payment is calculated to pay. This Adjustable Rate Mortgage Calculator allows you to explore just how a varying rate might affect your mortgage payments over time. The monthly payment is calculated to pay off the entire mortgage balance at the end of a year term. After the initial period, the interest rate and monthly. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Unlike fixed rate mortgages, the payments on an adjustable rate mortgage will vary as interest rates change. Use our adjustable rate mortgage (ARM) calculator. The current interest rate of the index used to calculate the interest rate on this Adjustable Rate mortgage. The current index rate plus the margin on that rate. Use our adjustable rate mortgage calculator to find how much your payments could be. Calculate interest rates, amortization and how much you could afford. This calculator shows a "fully amortizing" ARM, which is the most common type of ARM. The monthly payment is calculated to pay off the entire mortgage balance. The monthly payment is calculated to pay off the entire mortgage balance at the end of a year term. After the initial period, the interest rate and monthly. Click here to use the mortgage adjustable rate calculator in the CrossCountry Mortgage resource center. Adjustments: Rate fixed for 60 months, adjusts every 12 months %. Press spacebar to show inputs. The adjustable rate mortgage (ARM) calculator helps calculate what your monthly payments may be with an arm loan from U.S. Bank. Calculate your mortgage payment for an adjustable-rate mortgage (ARM). This home loan calculator makes it easy for you to calculate your monthly payment for. This calculator shows a "fully amortizing" ARM, which is the most common type of ARM. The monthly payment is calculated to pay off the entire mortgage balance.

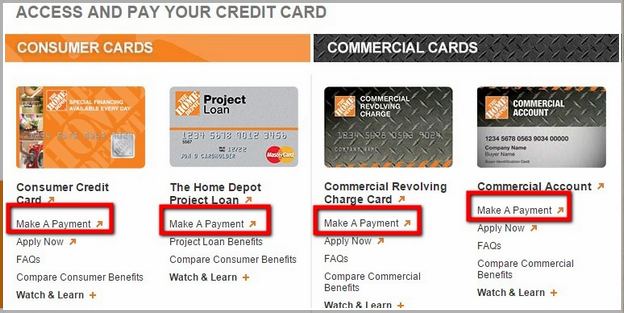

Home Depot Charge Card Payment

Payment Addresses. Payment Addresses. The Home Depot® Commercial Account Payments Home Depot Credit Services P.O. Box Louisville, KY Home. The Home Depot has 2 types of business cards, the commercial revolving credit card and the charge card. Both report payment history to the business credit. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. The Home Depot Consumer Credit Card. Overall card rating. Reviews payment in the mean time. It just means there is no interest. There also is. Next, add your payment methods, including all of your Home Depot credit cards, in order to track your purchases. If you delegate spending to your employees, you. Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the. Credit Card Services - The Home Depot · Pay and Manage Card · · Card FAQs. Your billing statement also shows your transactions; the Minimum. Payment Due and payment due date; your credit limit; and your interest charges and fees. On. How do I make a payment on my account? You can make payments by mail, phone or online. BY MAIL - Make checks payable to “Home Depot Loan Services.” Dept Payment Addresses. Payment Addresses. The Home Depot® Commercial Account Payments Home Depot Credit Services P.O. Box Louisville, KY Home. The Home Depot has 2 types of business cards, the commercial revolving credit card and the charge card. Both report payment history to the business credit. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. The Home Depot Consumer Credit Card. Overall card rating. Reviews payment in the mean time. It just means there is no interest. There also is. Next, add your payment methods, including all of your Home Depot credit cards, in order to track your purchases. If you delegate spending to your employees, you. Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the. Credit Card Services - The Home Depot · Pay and Manage Card · · Card FAQs. Your billing statement also shows your transactions; the Minimum. Payment Due and payment due date; your credit limit; and your interest charges and fees. On. How do I make a payment on my account? You can make payments by mail, phone or online. BY MAIL - Make checks payable to “Home Depot Loan Services.” Dept

Home Depot is refusing to take payments and accusing the customer of not paying their Pro Xtra card bills. A certain customer has filed. Once approved, cardholders receive a line of credit similar to other credit cards, which can be reused after payments are made. The card's interest rates range. What Other Forms of Payment Does Home Depot Accept?. . Home Depot accepts cash, credit/debit cards, PayPal, and Home Depot gift cards. Use Kudos When You. Home Depot offers different ways to pay your credit card bill when the time comes. Read this guide to see the easiest ways to pay your bill and avoid late. Payments. You can only make one online payment per day. You may schedule future payments as far as 45 days in the future. If you do not make one Online Payment. The Home Depot Consumer Credit Card is an ideal addition to any toolbox. Open an account today and enjoy No Interest If Paid in Full Within 6 months. 36 EQUAL PAYMENTS, 0% INTEREST*, NO ANNUAL FEES On Any Heating and Cooling System. when you use your Home Depot® Consumer Credit Card from Thursday. You can set it up with your bank to have your payment for your Home Depot card paid using ACH payment (Automatic Clearing House payment from. HOME DEPOT CREDIT SERVICES period. PO Box , St. Louis, MO Home Depot Card*. *Refer to The Home Depot Returns Policy for details. Select PayPal Credit at checkout to have the option to pay over time. Qualifying purchases could enjoy no Interest if paid in full in 6 months on purchases of. Enjoy the flexibility of paying your full balance or just the minimum payment due each month. 24/7 customer service. Questions about your Citi ® card account? Whether you want to check your online order status, manage your Home Depot credit card or check your Home Depot gift card balance, our online Help Center. Bring your monthly statement or The Home Depot Credit Card to you local The Home Depot store to make a payment in-store. You can mail in your payment to the. Pay your Home Depot Credit Card bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. It gives you the benefits of a credit card, but you don't have to pay an annual fee for the privilege. Fair or better credit required. You will have good. Pay your The Home Depot Card (Citi) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. Where can I get answers for questions about my Home Depot Credit Card? If you have questions regarding your The Home Depot charge account, please contact our. The no annual fee Home Depot commercial account card is available with Net 30 terms or as a revolving credit line with low monthly payments. When using their. Neither The Home Depot Consumer Credit Card nor The Home Depot Commercial Revolving Charge Card can be accepted as payment for a Gift Card purchase. Once. Posting on behalf of customer for whom I manage such issues. Home Depot/Citi have been refusing to let the customer pay via either of them.

1 2 3 4 5